What is Fire Insurance?

It is a type of insurance that covers your property against any loss or damage due to accidental fire. The insured amount for the loss of property, repairing or reconstruction of your property will be provided by the company according to its terms and conditions.

Why should you buy Fire Insurance?

When you buy a house or set up a business, you have so many plans and dreams to fulfill with that property. By any chance, if it gets burnt by fire, all your dreams get shattered. But, if you have fire insurance then your loss can be compensated as a hole or to a larger extent. So, you should buy fire insurance to avoid such unwanted unpredictable accidents.

Who should buy fire insurance?

As it is a personal insurance policy, you can buy this policy only in the name of a single person. Building owners and/or content owners inside a building can buy this policy.

- Homeowners:- If you own a house, then you can buy a fire insurance policy.

- Renters:- If you have given your entire house or part of the house on rent, then you can buy this policy.

- Small business owners:- If you own a small business like a bookshop, stationary, small hotel, beauty parlor, godown keepers, etc. then you can buy this policy.

- Medium business owners:- If you own a business of more than one shop, hotel, restaurant, etc, then also you can buy this policy.

- Large business owners:- If your business is spread all over a district, a state, a country, or all over the world, then also you can buy this policy.

Important features of Fire Insurance

- Tenure:- The Duration of this policy is 1 year. After that, you have to renew it.

- Type of insurance:- It is an indemnity insurance plan. This means, that this policy covers your losses up to the sum insured.

- Coverage:- It covers the damage or loss of property due to accidental fire or any other such accidental causes.

- Insurable Interest:- You must have insurable interest both at the time of purchasing and loss/damage. Here insurable interest means the thing whose damage or loss can cause financial loss to you.

Let us take an example. Let your washing machine get burnt in a fire. If it gets destroyed or it is damaged, in both cases you have to bear a financial loss for either buying a new washing machine or for repairing it. So, here in this case you have an insurable interest. But, if the washing mashie of your neighbor is damaged, in this case, you do not have to bear any loss. So, in this case, you do not have an insurable interest.

Characteristics of Fire Insurance

- Indemnity policy:- It is an indemnity policy. So, it covers the damage or loss of properties due to fire, flood, and other covered calamities up to the insured amount.

- Contract of good faith:- This policy runs well when both the insurer and the insured have faith in each other. Both the insurer and the insured should disclose all required details at the time of purchase of the policy.

- Tenure:- generally, the duration of this policy is 1 year. After that, you have to renew it to avail the benefits.

- Insurable interest:- You can claim this policy, only when you have insurable interest on the property that got destroyed, lost, or damaged. You should have insurable interest at both the time of purchase and claim. Insurable Interest means the property whose loss or damage can cause financial loss to you.

- Personal insurance contract:- This is a personal insurance policy. So, the insurer should have all the information about the insured person for the entire insurance duration. You can transfer your policy only if your insurer permits you. The insurer can also terminate your policy if you transfer your insured property to someone.

- Personal right: When an insured property is damaged or lost due to accidental fire, landslide, or other such unwanted situations, then the insurer will provide the claim amount only to the person, whose name is mentioned in the policy.

- Direct loss:- As the name suggests, the root cause of the damage or loss of property should be fire.

- Description of the property:- Fire insurance says you should mention the location of the insured property at the time of purchase. If its location changes in the future, then you should inform the company about it. Otherwise, you will not get the compensation.

What is covered under Fire Insurance?

- Fire:- When any of your property gets damaged or destroyed completely by accidental fire, then the loss will be covered by this policy.

- Explosion:- This policy covers the damage due to an explosion.

- Cyclone:- Any damage to your property due to a cyclone will be covered by this policy.

- Flood:- When your property gets damaged due to a flood, then the losses will be covered by this policy.

- Lightening: – Damages due to lightning like a crack in the wall, or shut circuits causing fire are covered under this policy.

- Aircraft damage:- If your property gets damaged due to a collision with an aircraft or due to a drop of something from the aircraft, then the loss will be covered under this policy.

- Earthquake:- It also covers damages due to earthquakes.

- Landslide, rock slide:- Property damage due to landslide or rock slide is also covered under the fire insurance policy.

- Other natural calamities:- Damages due to other natural calamities like tsunamis, storms, etc. are also covered under this policy.

- Bush Fire:- If a bush fire spreads to your property and burns it, then the losses will be covered by this policy.

- Impact damage:- If your property gets hit by an external animal, vehicle, or any off-track train, then this policy covers the damages. However, any of these vehicles or animals should not be owned by the property owner.

What is not covered under Fire Insurance?

- Damage by a working employee: – Any damage done to the property by a working employee of the organization is not covered under this policy.

- Damage due to War, attack, and other such conditions: – If your property gets damaged or lost due to war, attack, riots, or any other such situations, then the damages will not be covered by your policy.

- Damage due to any nuclear weapon: – If any nuclear weapon damages your property, then it will not be covered under this policy.

Other such conditions, where your damaged or lost property is not covered by this policy are:

- Damage due to pollution or contamination.

- Damage or loss in any electrical or electronic machines (except fans and electrical wiring) due to overworking, short circuits, etc.

- Loss or damage due to theft during any covered situations like an explosion, accidental fire, etc., or in general situations (Theft during riots, war-like situations is an exception).

- Loss or damage due to self-attempt.

- Loss or damage of products in cold storage due to temperature change.

- Fees or expenses of claiming your policy.

- Burning of property by the order of government authority.

Fire Insurance add-ons

When you pay some extra premium, you can avail the following additional coverage.

- Loss of rent

- Alternate accommodation

- Start-up cost

- Earthquake

- Forest fire

- Wreckage removal

- Coverage for molten metal spillage

- Unconstrained burning

- Leakage and contamination cover

- Damage to stocks due to change in temperature

- Impact loss owing to the insured’s own rail or road transit

Types of fire insurance

These are some common types of fire insurance provided by insurance companies.

- Specific policy:- In this type of fire insurance, a specific amount is insured for a specific property. hen that property is lost, damaged, or burnt completely, then all the losses will be covered by the policy till it does not reach the insured limit.

- Floating policy:- This policy covers more than one property present at different places at the same time under a single premium.

- Valued policy:- In this policy, the value of a particular property is decided at the time of purchase of the policy. When the property gets destroyed or damaged, that previously decided value will be provided, not the value at the time of fire or damage.

- Valuable policy:- Here the claim amount is decided on the market value at the time of loss or damage of the property.

- Comprehensive policy:- It covers damage due to many things like fire, flood, theft, riots, etc. according to the terms and conditions of the company.

- Average policy: – Here total loss will be covered if the value of the property is less than the insured amount. But, if the value of the property is more than the insured amount, then the compensation amount will be less than the actual loss.

Compensation amount = Insured amount/value of property X Actual loss

Example – Let you have taken an average policy of Rs. 3,00,000. Your property is of value Rs. 4,00,000. Your property got damaged and you faced a loss of Rs. 1,20,000. Here you will not get your total loss amount. The amount you will get from the company will be

Compensation amount = 3,00,000/4,00,000X1,20,000 = Rs. 90,000

So, you will get Rs. 90,000.

- Consequential loss policy:- This policy is also called loss in profit policy. Because in this policy you will get the amount you lost in profit due to loss in production, sales, or any related things.

Let us take an example to understand it properly. Let you have a factory of mango juice. A certain part of your factory with machinery gets burnt due to lightening. So, your production stopped. Now you can sell only those products, which are in stock. So, you get a lesser profit, Rs. 3,00,000 this month. In regular time you get a profit of Rs. 5,00,000 per month. So, you will get a compensation of Rs. 2,00,000 along with the cost of machines in this policy.

Hence, this policy covers both loss of physical material (tangible) and intangible(Things that we can not touch) loss.

Fire Insurance plans available in India

These 4 fire insurance plans are available in India.

- Bharat Sookshma Udyam Suraksha Policy: – It is the policy for businesses. Under this policy, office buildings, factories, machines, stocks, and other assets are protected up to a total amount of Rs. 5 crores.

- Bharat Laghu Udyam Suraksha Policy: – This is also a policy for businesses. It covers buildings, factories, machines, stocks, and other assets from Rs. 5 crores to Rs. 50 crores.

- Standard Fire and Special Perils Policy: – This policy covers damage or loss to buildings, factories, and other assets beyond Rs. 50 crores.

- Bharat Griha Raksha Policy: – This is the policy for your home. It covers the house and its contents of both individuals and society from fire and other perils.

What should you consider while purchasing Fire Insurance?

Considering the right things is as important as purchasing fire insurance. Because this will give you better safety at the time of your property loss or damage.

Checkout out the things you must look at carefully at the time of purchase:

- Sum insured:- You must look into the sum insured by your policy. You can choose the right sum to be insured by selecting the appropriate items in the list of properties to be insured. List all the things you want to be insured, at the time of purchase. Do not hurry to buy the policy so that you will not face any problems during claiming your policy. You should buy a policy with an adequate insured amount. Because financial loss due to fire, flood, landslides, etc. can be very high.

- Inclusions and exclusions:- You must look carefully at what is included and what is excluded in the policy. Make sure that all the properties you want to be covered must be included in your policy.

- Deductibles:- This means the amount of money you have to pay in case of loss or damage before the release of the rest of the insured amount. For example, let’s assume you have bought a policy with Rs. 3,000 deductible. You lost property of Rs. 20,000. Then at the time of claiming, you will pay Rs. 3,000 and your insurer will pay the remaining Rs. 17,000.

By opting for a deductible, the premium amount will decrease. But opt for the deductible amount that you can afford. - Description of property:- You must mention the details and location of your property at the time of purchase. Because this policy covers the damage or loss of the property in the mentioned location only. In the future, if you change the location of the property, then you should inform your insurer.

- Add-ons:- As the main coverage of the policy is loss due to fire, you should include other coverage by taking the add-ons according to your requirements.

- Take steps to reduce premiums:- Insurance providers keep conditions for reducing the premium amount so that you will not behave carelessly after purchasing fire insurance. So, take appropriate steps like fire indicators, no smoking zone, fire extinguishers, etc.

- Compare before purchasing:- Do not hurry at all to buy this policy. Compare the policies of different companies and different policies of the same company. Then purchase the policy that suits your needs the best.

- Buy the policy online:- You should buy the policy online. Because it saves your time, reduces the premium due to the absence of agents, gives you a better comparison, and has many more advantages over buying it offline.

Eligibility Criteria to Buy a Fire Insurance

Look at the list of some organizations that can buy fire insurance.

- Hospitals

- Banks

- Educational institutes

- Godown keepers

- Hotels and Restaurants

- Industrial manufacturing firms

- NGOs

- Traders in stock

When can you claim your Fire Insurance?

Whenever any of your properties get destroyed, lost, or damaged due to any reason that is covered in your policy, then you can claim your fire insurance policy. But, you should make sure that you have an insurable interest in that property. This means, that due to the loss of that property, you will face financial loss. You can not claim your policy for the loss of your neighbor. Because in this case, you will not face any financial loss.

So, inform your insurer immediately after the unwilling mishap to get the benefits in the right way at the right time.

Remember another thing. The approved money will come in the name of the person, whose name is mentioned in the policy. So, if you are the owner of the property, then only file a claim for its loss.

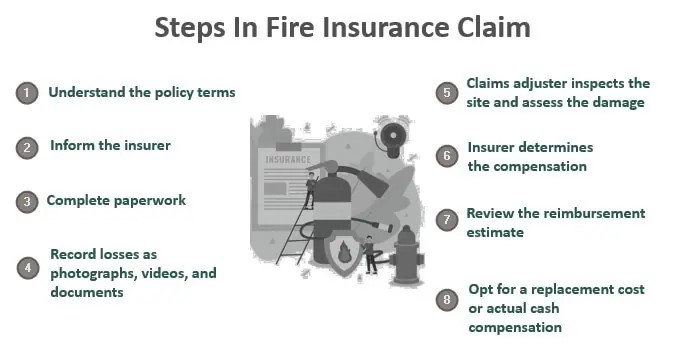

How to claim Fire Insurance?

You can get the best benefits under this policy when you file the claim correctly. Follow the steps given below, when you have to claim your policy.

- First, inform your insurer immediately after any kind of mishaps that need a claim, which is covered in your policy.

- Also, call the fire brigade and the police.

- Keep all the details of the property prepared.

- Calculate the estimated cost of the loss of property.

- A surveyor will come from the insurer.

- Fill claim form carefully and submit it to the surveyor with all required documents.

- Assist the surveyor whenever required.

- After visiting the place and reviewing all the documents, the company will approve your claim.

- After approval, the company will settle your claim within 15 to 30 days.

Document required to claim Fire Insurance

Make sure, you have all these documents while claiming your policy.

- Duly filled claim form

- A copy of the policy

- Substantial proof like a newspaper cutting if available

- Records of previous claims if applicable

- Photographs

- Report by the fire brigade

- Forensic report if needed

- Final investigation report