Generali and Central Bank of India: A Strategic Alliance

In a move that has caught the attention of the global financial sector, Italian insurance giant Generali and India’s Central Bank of India have joined forces to create a potentially game-changing partnership in the Indian insurance market. This strategic alliance not only marks a significant milestone for both entities but also signals a new era in India’s rapidly evolving insurance industry.

The Big Picture: A Landmark Partnership

A Historic Decision

On November 21, 2024, the Reserve Bank of India (RBI) granted approval for Central Bank of India to enter the insurance business through a joint venture with the Generali Group. This decision follows the Indian government’s 2021 move to increase the Foreign Direct Investment (FDI) limit in the insurance sector from 49% to 74%, opening new avenues for international collaboration.

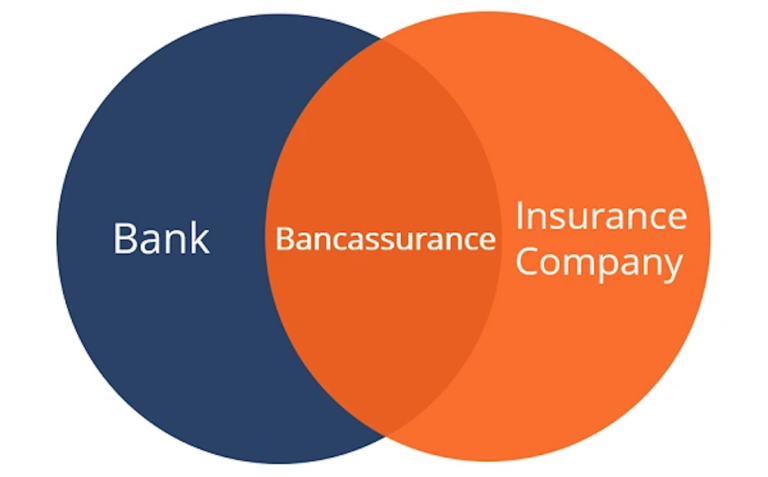

The Structure of the Alliance

The partnership between Generali and Central Bank of India will operate under two key entities:

- Future Generali India Insurance Company Ltd (FGIICL)

- Future Generali India Life Insurance Company Ltd (FGILICL)

This dual-pronged approach allows the alliance to cover both general insurance and life insurance sectors, providing a comprehensive suite of insurance products to Indian consumers.

Central Bank of India: A New Chapter in Insurance

Expanding Horizons

For Central Bank of India, this venture represents a significant expansion of its financial services portfolio. As a state-owned bank with a vast network across India, its entry into the insurance sector is poised to bring about several key advantages:

- Diversification of Revenue Streams: By entering the insurance business, Central Bank of India can reduce its dependence on traditional banking income.

- Leveraging Existing Customer Base: The bank can cross-sell insurance products to its extensive customer network, potentially leading to rapid market penetration.

- Enhanced Financial Services Ecosystem: This move allows the bank to offer a more comprehensive suite of financial products, potentially increasing customer retention and loyalty.

The Acquisition Process

Central Bank of India’s journey into the insurance sector has been methodical:

- In August 2024, it emerged as the successful bidder for stake acquisition in Future Enterprises Ltd’s insurance ventures.

- In October 2024, the Competition Commission of India (CCI) cleared the proposed stake acquisitions.

- The bank will acquire a 24.91% equity stake in FGIICL and a 25.18% stake in FGILICL.

Generali: Strengthening Its Indian Footprint

A Strategic Move in a Key Market

For Generali, this partnership with Central Bank of India represents a significant strengthening of its position in one of the world’s fastest-growing insurance markets. The Italian insurer’s strategy aligns well with India’s growth trajectory:

- Market Expansion: India’s low insurance penetration (around 4% of GDP) presents a massive growth opportunity.

- Local Partnership Advantage: Collaborating with a well-established Indian bank provides Generali with invaluable local market insights and an extensive distribution network.

- Product Innovation: Generali can leverage its global expertise to introduce innovative insurance products tailored to the Indian market.

Generali’s Global Strategy

This move is part of Generali’s broader strategy to expand its presence in high-growth markets. The partnership with Central Bank of India allows Generali to:

- Gain a stronger foothold in the Indian market

- Diversify its global portfolio

- Tap into India’s digital transformation wave in the financial services sector

Impact on India’s Insurance Landscape

Market Dynamics

The Generali-Central Bank of India partnership is set to shake up the Indian insurance market in several ways:

- Increased Competition: The entry of a major global player partnered with a significant Indian bank will likely intensify competition, potentially leading to better products and services for consumers.

- Innovation Boost: Generali’s global expertise combined with Central Bank of India’s local knowledge could lead to innovative insurance solutions tailored to the Indian market.

- Digital Transformation: Both partners are likely to invest heavily in digital infrastructure, potentially accelerating the adoption of insurtech solutions in India.

- Expanded Reach: The partnership could significantly improve insurance penetration, especially in semi-urban and rural areas where Central Bank of India has a strong presence.

Regulatory Implications

This partnership also highlights the evolving regulatory landscape in India’s insurance sector:

- It showcases the success of India’s policy to increase FDI limits in insurance.

- The move may encourage other global insurers to seek similar partnerships with Indian banks.

- It could lead to further regulatory reforms to facilitate such international collaborations.

Challenges and Opportunities

While the partnership presents significant opportunities, it also faces several challenges:

- Cultural Integration: Merging the operational cultures of an Italian insurer and an Indian public sector bank could be complex.

- Product Customization: Adapting Generali’s global products to suit the diverse Indian market will be crucial.

- Regulatory Navigation: Adhering to evolving Indian insurance regulations while implementing global best practices will require careful navigation.

- Technology Integration: Aligning the technological infrastructures of both entities to create a seamless operation could be challenging.

Looking Ahead: The Future of Generali and Central Bank of India in India’s Insurance Market

As this partnership unfolds, several key areas will be worth watching:

- Product Innovation: How will the joint venture leverage Generali’s global expertise and Central Bank of India’s local knowledge to create unique insurance products?

- Distribution Strategy: Will the partnership focus on digital channels, leverage Central Bank of India’s physical network, or adopt a hybrid approach?

- Market Share Growth: How quickly can the joint venture capture market share in both life and general insurance segments?

- Rural Penetration: Given Central Bank of India’s extensive rural presence, how will the partnership approach the underserved rural insurance market?

- Digital Transformation: What kind of digital initiatives will the partnership undertake to stay competitive in an increasingly tech-driven market?

Conclusion: A New Era in Indian Insurance

The partnership between Generali and Central Bank of India marks a significant milestone in the evolution of India’s insurance sector. It represents not just a change in market dynamics but a potential catalyst for transformation in how insurance products are developed, distributed, and consumed in India.

As this alliance takes shape, it has the potential to:

- Accelerate insurance penetration in India

- Bring world-class insurance practices to the Indian market

- Drive innovation in product development and customer service

- Contribute significantly to the overall growth of India’s financial services sector

The success of this venture could set a precedent for similar international collaborations in India’s financial sector, potentially ushering in a new era of global-local partnerships aimed at serving the diverse and growing needs of Indian consumers.

As India continues its journey towards becoming a global economic powerhouse, partnerships like the one between Generali and Central Bank of India will play a crucial role in shaping the future of its financial services landscape. The insurance sector, in particular, stands at the cusp of a transformative period, with this alliance potentially leading the way in innovation, accessibility, and customer-centric solutions.